Moving from Ohio to Florida? While the warmer state might be an attractive option for those looking to escape the Ohio cold, it is important to understand the implications such a move might have on your estate. In Part 2 of …

Securing the Future

Our trust and estates group believes the most effective solutions go beyond the numbers. It’s about the lives of the people you love and meeting their needs as time moves forward.

We offer a continuum of tailored legal strategies to meet ever-changing needs. From trusts of all kinds to comprehensive estate planning, we can help you map out a bright future for your family and loved ones.

In some instances, families want to preserve assets in the future for many generations. For example, parents may have a strong desire that the family farm stay in the family for future generations who will benefit from income and otherwise enjoy the property, but not have control over the property.

One tool to accomplish this is a dynasty trust. Dynasty trusts can be designed to hold property for the enjoyment of many generations. There are a number of important considerations in developing a dynasty trust, including selecting a trustee and successor trustee(s), in addition to determining how long the trust will last.

With thoughtful and experienced planning, a dynasty trust can be the perfect solution for a family asset to stay in the family for many generations.

For most senior citizens, the possibility of a long-term nursing home stay is a foreboding consideration. Approximately 40% of senior citizens require some level of nursing home care prior to their passing. While most of us fear the prospect of our own healthcare crisis, planning in advance, can provide security for our families and loved ones.

With monthly nursing home rates in the range of $10,000, many families cannot afford this expense and need to explore alternative options to support their long-term healthcare.

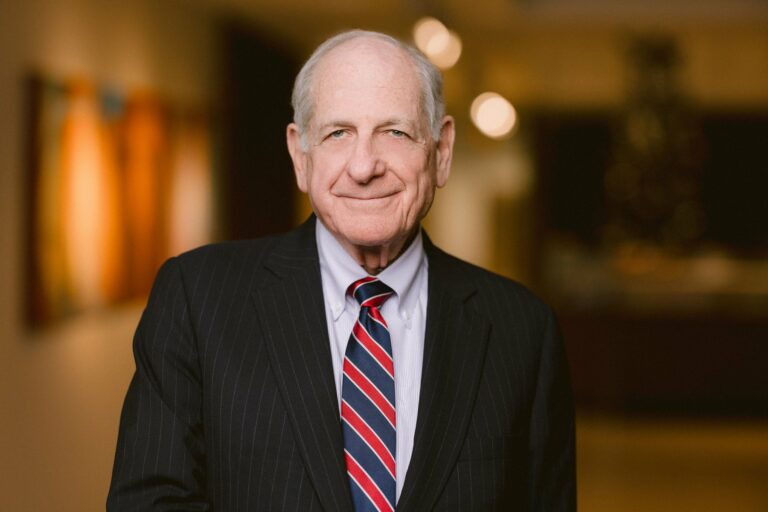

Isaac Wiles has the expertise of a seasoned team of elder law attorneys and a committed and experienced staff. Our attorneys have been involved in nearly every precedent-setting case in the state of Ohio relating to elder law and Medicaid eligibility. We stay abreast of any changes or updates related to Medicaid and we understand how those changes impact our clients’ long-term healthcare plans.

In circumstances where one spouse requires nursing home care and the other spouse is able to stay at home, our primary focus is on preserving sufficient assets and income for the well spouse to continue residing in the community, both in the short term and long term. The greatest risk to the well spouse is impoverishment after the death of the ill spouse, when the monthly income typically drops by 40%. At Isaac Wiles, we are proud to offer customized planning options and assist in retaining greater wealth for the well spouse in these particular situations.

Unlike “seminar lawyers,” we do not participate in the sale of annuities or any other insurance products, directly or indirectly. Our goal is to assist our clients in providing a secure future for the well spouse and limiting the financial exposure should nursing home care be required.

The most important step in the estate planning process is the formulation of a family estate plan and the preparation of the documents to carry out that plan. The estate plan sets forth a family’s wishes concerning the disposition of the family wealth, the selection of individuals to carry out the plan and the selection of persons to care for, and be in charge of minors, who lose their parents.

Typical estate planning documents include wills, financial powers of attorney, health care powers of attorney, living wills, and perhaps, funeral directives. For many families, trust instruments are also important tools in putting together an estate plan and protecting the beneficiaries.

The process of document preparation can be made very efficient by using questionnaires, emails and phone conferences, followed by a client meeting to review and sign the final product. However, client meetings can be arranged at any time during the document preparation process.

Estate planning is important for adults who have others depending on them for support, such as minor children or even elderly parents. An effective estate plan ensures a client’s wishes are carried out for the distribution of their assets and for the guardianship of minor children rather than leaving such a decision to a court of law. Our estate, trust and probate attorneys expertly guide clients through the creation of an effective and cost-efficient estate plan which gives them, and those that depend on them, peace of mind if something were to happen unexpectedly.

Many people want to “avoid” probate because they perceive it as a “hassle. There are a number of estate planning “tools” that our attorneys utilize to allow our clients’ assets to pass seamlessly to their loved ones after they have passed. For high net-worth clients, trusts can be tailored to reduce or defer potential estate taxes, which in 2019 is over $11.1 million dollars per person.

If probate cannot be avoided or when a client is faced with the death of a relative who died “intestate” (without a Will), our attorneys are ready to assist them with probate administration. Probate is there to facilitate the transfer of real and personal property of a decedent to their rightful heirs and beneficiaries. Probate can be as simply as transferring the title to an automobile or more complicated, depending on the size of the estate. No matter the size, our team handles every probate administration compassionately and in a cost-effective manner.

A beneficiary of an estate or trust is often overwhelmed by the amount of information to process and the responsibilities of being named a beneficiary. In addition, a beneficiary may receive little or no communication from an executor or trustee, or he/she may distrust the executor/trustee and has concerns whether that person is acting in his/her best interests.

A beneficiary may engage legal counsel to represent them in the administration of the estate or trust to assist in understanding the importance of:

– information received from the fiduciary

– when to take action

– tax ramifications of an inheritance.

An attorney is also needed if a beneficiary believes that a fiduciary is not acting in the best interests of the beneficiary or is not carrying out the fiduciary’s responsibilities properly or in a timely manner.

A living trust is a very important part of most individual’s estate plans. Young couples with children will often employ a joint living trust to provide for their young children and manage assets for the children’s benefit if the parents die prematurely.

A living trust is an excellent way for a couple to hold assets to avoid probate and provide for adult children, grandchildren, charities, etc.

Single individuals find a living trust an excellent way to own property to avoid probate and also, to designate an individual who can manage assets as a trustee if the individual is not physically or mentally able to do so.

Sometimes it becomes necessary for an executor of an estate, or the trustee of a trust to commence court litigation to interpret a document or to recover assets belonging to a decedent.

A beneficiary of an estate or a trustee may find it necessary to seek to remove a fiduciary or otherwise protect an inheritance. Our attorneys are experienced litigators who can file court actions or defend against them to protect a client’s interests.

Most public benefits available for disabled individuals impose harsh, below-poverty limits on assets and income. However, there are often plans by which a disabled individual may hold assets that will not count against his/her limits, while still providing financial benefits to him/her. Isaac Wiles estate, trust and probate attorneys are experienced in establishing first-party special needs trusts and third-party discretionary trusts, as well as coordinating the use of STABLE accounts or pooled trusts.

Not every option is available for every situation, so we work to help identify what is possible for each client. Individual plans must be tailored to the beneficiary’s assets, age, capacity and particular benefit. Because these “safe harbors” may also feature stringent requirements for construction or use, our attorneys help our clients understand their limits, rights, and responsibilities. We strive to find solutions to help disabled individuals and their families supplement their financial needs.

Estate and/or trust administration also includes compliance with income and estate/gift tax reporting compliance. Our estate, trust and probate attorneys assist our clients in determining what income tax returns to file and when. We help determine whether estate or gift tax returns are necessary so that the client is not subject to penalties, interest or other enforcement problems with the Internal Revenue Service or other taxing authorities.

Trustees have important fiduciary obligations and duties which are set forth in the specific trust and in the Ohio Trust Code. Trustees are responsible to carry out the terms of a trust and are responsible to its beneficiaries and third-parties with whom a trustee may deal.

Our attorneys assist trustees with such matters as trust interpretation, income and principal distribution, dealing with beneficiaries, required notifications and accountings, and the filing of tax returns on behalf of the Trust. When a trustee is ready to “wind-up” the Trust, we assist with the efficient termination and dissolution of the trust.

Those who are considering accepting a trusteeship should consult our attorneys, who will be able to advise as to the duties and responsibilities of the trustee under the Trust document and under Ohio law.